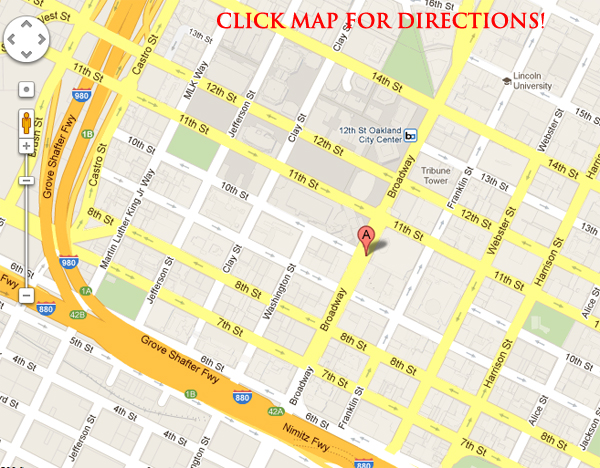

and YOU!Where: 10th and Broadway, downtown Oakland

When: Thursday, September 27th

—– Gather at 4 pm for pre-action briefing —–

(Press conference after action)

Zaki Alshalyan, our neighbor, an Oaklander from the east side is facing a sale date of October 4th!

We will be joining another community group, ACCE, to simultaneously take action on several banks in the downtown area.

We are sending a “delegation” to accompany Zaki and his family as they deliver a demand letter to his bank and their executives. We are demanding that they postpone his sale date and reopen negotiations with him in good faith.

In other words, he needs backup to make these bastards treat him like a human being.

And this is his story:

09/24/2012

My name is Zaki Alshalyan.

I am Iraqi-American and I was a prisoner of war in Operation Desert Storm 1991. I am one of thousands of Iraqis who stood up with the American army to fight with them against Saddam Hussein.

I spend 5 years in the prison. It was the worse place in the Saudi Arabian desert. I spent days and nights… months and years in this place without exit to anything. I can’t see anything except the sand and the sky…no plant, no bird, no animal can live there. Everyday my body was totally covered with sand because my tent where I slept was broken from the storms and sometimes I can’t see or breathe and the days turned to darkness. I suffered torture by Saudi guards many times. After seeking freedom for 5 years, I had the chance to meet the American delegation. They check my story and they accept me to live in the USA as a refugee.

I arrived in San Francisco on 1/15/1995. I had hope for my future and family I left behind. After one month in San Francisco, I started working two jobs 16 hours a day, 6 days a week… working hard and paying my taxes.

In May 2005, I had saved my money and put down payment to buy this property, a small four unit building in East Oakland.

Four years later, my hardship started when the bank started raising my mortgage payment until it reached 5000 dollars a month. I couldn’t pay the high payment. I ask the bank for help, for a loan modification. It took two years and the bank kept asking me for documents and paper work and I send them everything they ask for over and over. Finally, the bank denied my loan modification for no reason. The loan modification and hardship has negative effect on me and my job, on my wife and my three kids. Now I live in tough times.

After I spend all the money I had, after I borrow money from friends and family to fix the property, now the property is worth nothing – I owe more than the property is worth.

Bank of America sent me a letter saying they want to sell my property at auction on October 4th. I can’t lose my property. This is my only income. I have no other support for myself and my family.

I am now seeking help from you to put pressure on the bank to modify my loan and help me save my property.

Thank you very much,

Zaki Alshalyan

!! THURSDAY – 10TH AND BROADWAY – 4PM !!

Well, we went to the Chinatown branch of BofA – two OOFDG members, along with Zaki and his friend Asmat went in first at about 4:40, well before closing time, and asked to speak with the manager. They were seen by and presented their demand letter to the branch manager, who said she would fax it.

Our main contingent had stayed behind until these folks got into the bank (protesters showing up have a way of prompting bank employees to lock the doors these days). When we arrived, several more of us (myself included) went into the bank, at which point the security gates were closed and no more people were allowed in. We stayed with Zaki and waited for the manager to return with our fax receipt, all the while customers were doing their business and leaving. At no point did any bank employees or security guards tell us to leave. We waited for 20 minutes, with no bank employees approaching us for any follow-up or questions.

As the last of the other customers left, the manager returned and said she was having trouble sending the fax (she said she did not have the fax number on file, and had been trying to send it to the phone number on our flyer!) We said we would stay until she was able to obtain the correct number and return with our receipt. In the meantime, we called the number ourselves and Zaki got on the phone with a representative to ask for the fax number.

While this was happening, police arrived and told us the bank had called them to have us removed. At this point, we had the fax number ourselves, and asked to stay until our letter could be faxed. We explained that we had legitimate business to conduct, that we had done nothing disruptive inside the branch, and that we had always intended to leave when our business was done. Despite all this, we were told not to argue and were given one minute to leave or face arrest.

We discussed together and decided to leave – we joined our group on the sidewalk outside, where we were able to have our press conference, together with our group and the ACCE members who had been to Wells Fargo and Chase Bank.

The best news is, last night Zaki received a call with an offer to reconsider his modification application, and an assurance that his auction date had been moved to November 4.

* * * * * Time to keep the pressure on folks! Again, please call Debbie Haber, BofA Mortgage, 800-699-6650, for Zaki Alshalyan, Loan #131163177 – and let her know we will be back as necessary! * * * * *

Mr. Alshalyan purchased $1,227,000.00 (YES OVER ONE MILLION DOLLARS) of property in Oakland in 2005. On 6/21/2005 he purchased the Curran Ave. property for $757,000.00, then on 7/29/2005 he purchased the Harper St. property for $470,000.00. Both properties show multi family dwellings, however Mr, Akshalyan receive a $7,000.00 per year property tax Homeowner Exemption on the Harper St. property. The average down payment on investment property is 10% or $75,700.00 leaving a loan balance of $681,300.00, Mortgage Payment (Principal & Interest only) with a 9% interest rate (good rate for investment property in 2005) would be around $5,484.00 monthly. Now add the Harper St. property, down payment (5% for First Time Buyer, Owner Occupied) $23,500.00 leavening a mortgage balance of $446,500.00, Mortgage Payment (Principal & Interest only) with 6.625% interest rate would be around $2,859.00 monthly. That is a combined monthly mortgage payment of $8,343.00 not including insurance and property taxes.

Mr. Alshalyan also owns a limousine service, he filed a fictitious business name under Zacks Limousine Service on 6/4/2012. So Mr. Alshalyan is a Landlord, a multiple property owner and a business owner.

Given the purchase/closing dates of the 2 properties mentioned, the amount of down payments required and proof of income/reserves needed to sustain over $12K a month of mortgage payments, property taxes and insurance, it is not surprising that Mr. Alshalyan did not qualify for a loan modification on his INCOME property.

I hope the Foreclosure Defense Group was given all the facts in this case, just my 2 cents. 🙂

@yerba

No, this is his residence. Yes, he does rent to tenants.

All types of working people invest in property in one way or another to provide for themselves. Regardless though of ones opinion on landlording, you’d do well not to make assumptions about intentions and character sitting on your ass at a keyboard.

Come out and meet him on Thursday. He’ll be there with his family.

“In May 2005, I had saved my money and put down payment to buy this property, a small four unit building in East Oakland.”

Thats not his personal residence. a four unit building is an apartment. He is a landlord. He is an investor who lost money and is now using you because he bet and lost.