By Emily Wheeler, Strike Debt Bay Area

The problem with the world is that we draw our family circle too small. –Mother Teresa

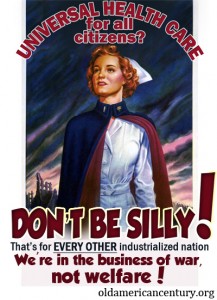

In a sane society, all people have wholesome food, clean water, livable shelter, and medical care. But in this capitalist society, which is set up to benefit the 1% at the expense of the other 99%, fewer and fewer people can get these basic needs met.

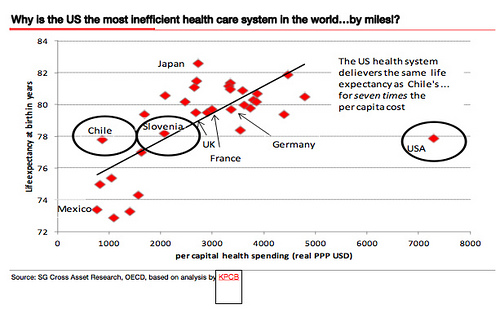

Nowhere is the current insanity more evident than in the US healthcare system. The drive to maximize profits for giant insurance and pharmaceutical companies—not to mention for-profit providers and hospitals—causes real hardship for millions and even avoidable death for some. Anthropologists from another planet would surely puzzle over a society like ours. How can we prioritize healthy dividends for Aetna stockholders over the well-being of almost everyone else?

As a society, we claim to value families. We want to help people take care of their children and their elders as well as themselves. But as the economic situation of non-wealthy people becomes more precarious, more families are being ruined, not by illness per se, but by the debt that illness forces them to take on. Medical debt causes 62% of all personal bankruptcies in the US. Think about it—someone who has the misfortune of a serious disease loses not only her health, but also all her possessions and her good credit rating. How can this be acceptable?

In 2016, the New York Times invited readers to tell how medical bills had changed their lives. Here is one personal story of financial ruin by medical debt:

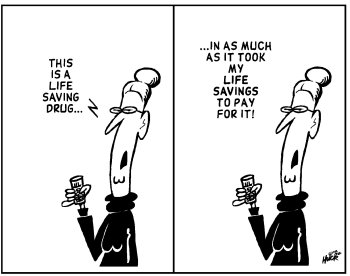

- I’m an educator with horrible insurance. I’ve always lived paycheck to paycheck. I’m 49, and two years ago had a massive heart attack that killed one third of my heart muscle. I’m now on 13 medications daily and must go to a heart transplant specialist at $1,200 per visit. I have maxed out my credit cards and will soon be filing for bankruptcy. This week, I’m hiding my car because it’s about to be repossessed. My medical bills have destroyed my life, but if I stop my prescriptions or doctor visits I’ll die.

For those who manage to avoid bankruptcy, medical debt can mean doing without the basics. More testimonies sent to the Times:

- I have gotten a second job to pay for my children’s medical expenses, which means that I am not able to spend as much time as I need to monitoring my 13-year-old son’s Type 1 diabetes. I am in debt and need to sell my house. I don’t go to the doctor myself to save money.

- Some weeks we barely eat. There are holes in my roof and an entire bathroom that is unusable because I cannot afford the repairs. Haven’t even been able to buy underwear or socks in over a year and a half. In addition, prescription “coverage” is a joke —my out-of-pocket costs are now equal to an eighth of my monthly paycheck. I am drowning.

- I can now only afford one meal a day; I seldom leave the house; canceled all donations/purchases and keep my house just warm enough to avoid hypothermia. Fortunately, I can look back on a decent life for 65 years, but the last five have been so depressing with hospital bills piled up on the table.

Even the threat of medical debt puts severe limits on life’s possibilities. It’s difficult to overestimate the enormous impact of our dysfunctional healthcare system on the lives of ordinary people. Many couples decide against having a child, or another child, because they can’t afford delivery costs or higher premiums. Some couples have even divorced so that one partner can qualify for Medicaid. Many workers stay in unsatisfying jobs because the health insurance is relatively decent.

And they are right to be nervous. Increasingly, employers are checking the credit of prospective hires; a bad credit rating due to medical or other debt can cause an applicant to be turned down for a job. So people who get sick, lose their job, go into debt to pay medical bills, and are stigmatized with a bad credit report are never able to regain their lost prosperity. They join the ranks of the poor for good.

With the arrival of the new, neo-fascist government in Washington, the situation will almost certainly get worse before it gets better. Obama’s Affordable Care Act (ACA) was never an adequate solution, but it did legislate the abatement of the worst of medical debt, albeit with caveats and loopholes. (Click here to learn more about bad credit and how it affects every aspect of daily life for someone who has it)

If and when the Republican Congress makes good on its threat to repeal “every last word” of the ACA, tens of millions more people will once again be subject to the vagaries of a free market for healthcare coverage.

Once again there will be limits on the amount an insurance company will pay over a year or a lifetime—meaning there will be no limit to the amount of debt an individual could incur seeking life-saving treatment. Once again the insurance companies will deny coverage for “pre-existing” conditions, making millions of people uninsurable for the very treatments they need to survive, forcing them to go into ruinous debt to get care, or die if they are not credit-worthy. Once again those with too much to be covered by a denuded Medicaid system—but earning too little to pay premiums, eat and pay rent at the same time—will be one kid’s bicycle accident away from bankruptcy.

In a sane society, the concepts of debt and medical care would not intersect. In a sane society, the care you receive, and whether you receive care at all, would not depend on your credit score.

This is not a society tending toward sanity. We the people must insist on healthcare as a human right for all, not a privilege for the few.

Strike Debt Bay Area, organized to fight against all aspects of unjust debt, is committed to fighting for a system of universal healthcare for all residents of the United States. In California, that fight is now being led by the HealthCare for All coalition.

Join Strike Debt Bay Area in that the fight. And others.

Comments are closed.